First of let’s understand what is CDS Rate?

The CDS spread, or Credit Default Swap rate, is like an insurance premium. It shows how much it costs to protect yourself against the risk that a country might not repay its debt. If the CDS rate is low, It means people think the country is likely to pay back its debt. If the CDS rate is high, there’s a big risk that the government will likely pay back its debt.

How does CDS work?

1. Insurance Against default:

Just assume that you lend money to the country or company, but you are worried that they might not pay you back. To protect yourself, you can buy CDS from someone else.

2. Paying the Premium:

You pay a regular fee (the CDS spread) to the seller of the CDS, just like paying an insurance premium.

In return, if the country or company you lent money to doesn’t pay back (defaults), the CDS seller will compensate you for your loss

3. Protection for Lenders:

This way, you’re protected even if the borrower can’t repay the loan.

Why It’s Important:

Impact on Borrowing Costs:

If a country’s CDS spread is high, it means that borrowing money will become more expensive for them because lenders will demand higher interest rates to compensate for the increased risk.

Market Sentiment:

The CDS spread market reflects what investors think about the global economy. A rise in CDS spread can indicate growing concerns about economic stability, especially for countries in financial or political turmoil.

Risk Management:

CDS helps investors manage the risk of lending money. If a lender is worried that a borrower might default, they can use a CDS to protect their investment.

Indicator of Financial Health:

The CDS spread acts as a signal of how risky a country or company is. If the CDS spread goes up, it means people are worried about the borrower’s ability to repay. It’s a warning sign that the borrower might be in financial trouble.

In short, CDS is a crucial tool for managing risk and provides insights into the financial health of countries and companies.

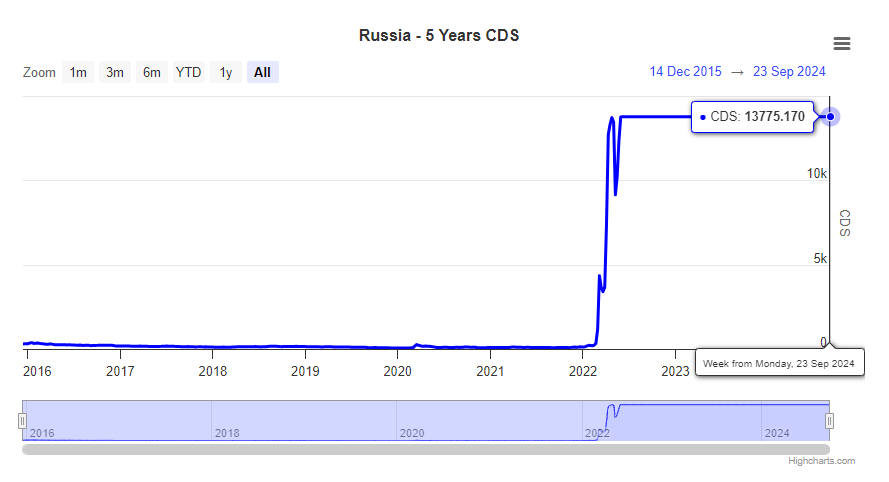

The chart you’re looking at shows how expensive it has become to insure against Russia not paying back its debts over the last few years. This cost is measured by something called the Credit Default Swap (CDS) rate.

Basic Understanding:

As of 23-09-2024, A CDS spread of 13,775 basis points means that it would cost $13,775 annually to insure $100,000 worth of Russian debt against default. This high rate indicates that investors believe there is a substantial risk of default because of the Russia – Ukraine War.

My Observation:

Steady and Low Risk (2016-2021):

For most of the time from 2016 to 2021, the CDS rate was very low. This means that investors didn’t see much risk in lending money to Russia. They felt confident that Russia would pay back its debts without any problems.

Big Spike in Risk (2022):

In February 2022, Russia invaded Ukraine. This was a major event that caused a huge jump in the CDS rate. The rate spiked from being almost nothing to over 13,775 basis points (or 137.75%). This means that investors suddenly became very worried that Russia might not be able to pay back its debts, so the cost of insuring against this risk skyrocketed.

Continued High Risk (2024):

As of August 2024, the CDS rate is still very high. This suggests that investors are still very concerned about Russia’s ability to pay back its debts. The ongoing war with Ukraine, along with economic sanctions from other countries and internal economic problems, have kept this risk high.

Read about the Cost of equity from here:

read about the risk from here:

Summary:

Before the Russia-Ukraine war, investors weren’t too worried about Russia’s ability to pay back its debts. But when the war started in February 2022, that all changed. The cost of insuring Russian debt jumped dramatically because people became very unsure about Russia’s future. Even two years later, in 2024, this cost remains high, showing that investors still see a big risk that Russia might not be able to pay its debts.

Ukraine CDS Rate:

So, The question is:

I noticed that Ukraine’s CDS (Credit Default Swap) rate is 571 basis points (bps) now, while Russia’s CDS rate is much higher at 13,775 bps. Back in February 2022, when the war started, Ukraine’s CDS was 333.60 bps and Russia’s was 218 bps. Even though both countries are at war, Russia’s CDS rate has gone up a lot more than Ukraine’s. Why is this?

Why Did Russia’s CDS Spreads Increase So Much?

Sanctions: Russia faced severe international sanctions, which restricted its ability to trade and access money. This made investors worried that Russia might not be able to pay its debts.

Economic Impact: The sanctions and the war caused big problems for Russia’s economy. Companies and banks struggled, leading to a higher chance of default, so CDS spreads shot up.

Isolation: Russia became more isolated from the global economy, making it harder for it to manage its finances.

Why Did Ukraine’s CDS Spreads Increase Less?

Less Severe Sanctions: Ukraine didn’t face the same level of international sanctions as Russia. This meant its economy wasn’t as disrupted.

Different Financial Impact: Even though Ukraine was affected by the war, it might have had better support or different financial conditions, which kept its default risk from rising as sharply as Russia’s.

Russia’s CDS spreads went up much more because its economy faced tougher problems due to sanctions and isolation by most of the world courtiers, making investors think there’s a higher risk of default. Ukraine’s CDS spreads did increase, but not as dramatically, because its financial situation wasn’t hit as hard by sanctions.

Discover more from Growth Inshots

Subscribe to get the latest posts sent to your email.

218GB PREMIUM Studio HD Videos FORUM TORRENT

CHILD PORNO PHOTO ASIAN CP VIDEOS DARKNET PICTURE ONION LINKS DOWNLOAD

218 GB MAGNET LINK FOR TORRENT CLIENT (ADD URL) magnet:?xt=urn:btih:abd5aaed52b5994fe54136701c4c18156bd28415

WEBSITE: OPEN IN AN ANONYMOUS TOR BROWSER (the link does not work in other browsers) LINK: http://torx5mtxatfovjmdizm27tsqusa4bgej5qx7zvv2quxvh44spl5xzsad.onion

Отличные скидки на товары от Microsoft, которые не оставят вас равнодушными.

microsoft 365 бессрочная лицензия [url=https://www.best-lip-filler.com/]https://www.best-lip-filler.com/[/url] .

Useful information about double glazed windows in Melbourneeuropean tilt windows european tilt windows .

Why do people keep pets, the advantages of pets.

tips for choosing a pet, which pet breed is right for you.how to ensure comfort and care for pets, how to feed pets.fun facts about pets, why people adore pets.tips for training pets, how to train a cat to walk on a leash.

domestic animals black and white images domestic animals black and white images .

New inventions that will make you question what’s possible, incredible inventions pushing the boundaries of science.

best inventions 2023 https://washingtondchotelsonline.com/index.php/2024/06/13/unsung-heroes-forgotten-inventions-that-made-history/ .